ETFs in focus: investors trade against traditions

Where capital is leaving equities

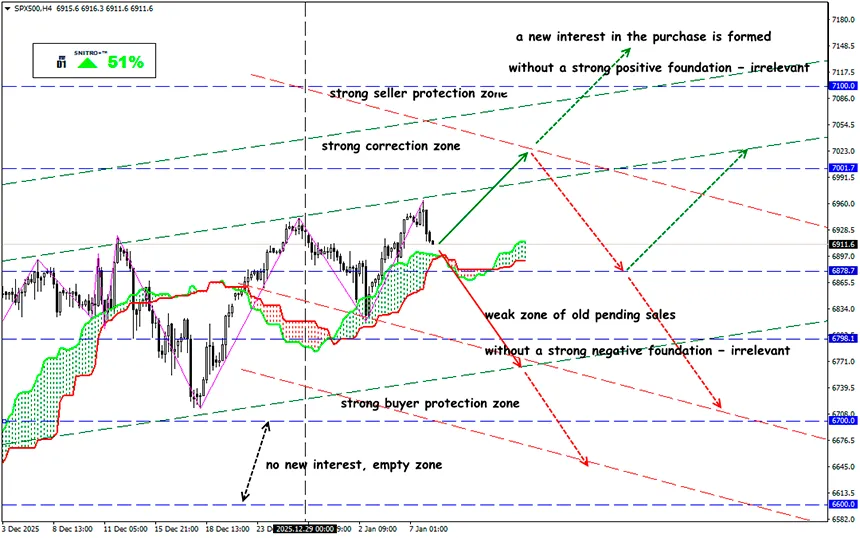

SP500

Key zone: 6,850 - 6,950

Buy: 7,000 (on strong positive fundamentals); target 7,100-7,150; StopLoss 6,950

Sell: 6,850(on a confident breakout of the 6,870 level); target 6,750-6,700; StopLoss 6,900

In 2025, a clear shift in capital structure formed in the equity market: investors are increasingly favoring ETFs while reducing positions in individual stocks. This is not about declining interest in the market – capital is simply changing its format.

According to Bank of America data, in 2025 the bank’s clients purchased ETFs worth $55 billion while simultaneously selling individual stocks for $96 billion. Although the outflow from equities slowed compared to last year, capital inflows into ETFs continue to accelerate.

Why Capital Is Being Reallocated Into ETFs

The current dynamics confirm a stable trend: investors are selling individual securities and moving into ready-made diversified baskets that trade like ordinary stocks. This is not a “flight from the market,” but an optimization of risk structure and portfolio management.

Key advantages of ETFs:

- Simplicity and efficiency: one instrument provides diversification across dozens or hundreds of stocks;

- Reduction of idiosyncratic risk: a mistake in one company does not lead to the loss of the entire capital;

- Flexible risk management: ETFs can be bought and sold intraday;

- Psychological factor: holding “the market as a whole” is easier than constantly selecting individual winners.

Growing Interest in Gold and Silver ETFs

A separate trend has been the increase in investments in physically backed precious metals ETFs:

- Gold and silver ETFs allow adding a defensive component to a portfolio without the need to store the metal;

- Gold in ETF format is viewed as a more reliable instrument during periods of uncertainty compared to the spot market;

- Silver is characterized by higher volatility: it can rise faster than gold, but corrections are deeper;

- Silver is easier to analyze due to the high share of industrial demand.

Sectors With the Largest Capital Outflows

Based on flows into funds and sector ETFs in 2025, the most noticeable losses of investor interest were recorded in the following segments:

- Healthcare (healthcare and biotechnology) – pressure is linked to uncertainty and weak expectations;

- Consumer Discretionary – the sector is sensitive to interest rates and household income;

- Financials – during periods of market stress, it often acts as a “liquidity donor,” from which investors exit to quickly reduce risk.

At the same time, free capital is predominantly concentrated in large companies, while small- and mid-cap stocks receive significantly less attention.

ETFs for Medium-Term Trading Strategies

Under current market conditions, ETFs with high and stable liquidity traded on U.S. exchanges stand out for strategies with horizons from several weeks to months:

- SPY – SPDR S&P 500 ETF Trust (500 largest U.S. companies);

- QQQ – Invesco QQQ Trust (NASDAQ 100 index);

- VTI – Vanguard Total Stock Market ETF (entire U.S. market: large-, mid-, and small-cap);

- XLY – Consumer Discretionary Select Sector SPDR Fund;

- XLF – Financial Select Sector SPDR Fund;

- XLK – Technology Select Sector SPDR Fund (growth stocks);

- GLD – SPDR Gold Shares (physically backed gold ETF);

- IAU – iShares Gold Trust (alternative to GLD with lower costs);

- SLV – iShares Silver Trust (silver ETF oriented toward more aggressive trading).

And What Is the Result?

Modern ETFs are becoming a key tool for risk management and capital reallocation. Investors increasingly use them as the primary “transport” for money, reducing dependence on the quality of analysis of individual issuers. Buying gold and silver via ETFs has become entrenched as a popular hedging method.

The highest risks of sell-offs remain in healthcare, consumer discretionary, and the financial sector, especially under nervous market conditions.

Recommended ETF portfolio structure for medium-term strategies:

- 60% – broad market ETFs;

- 20% – sector ETFs;

- 20% – defensive block (gold and silver).

At the same time, silver requires especially strict risk management discipline.

So we act wisely and avoid unnecessary risks.

Profits to y’all!