Caribbean oil: a dangerous $100 billion gamble

Speculators Are Waiting in Vain — It Will Not Get More Expensive

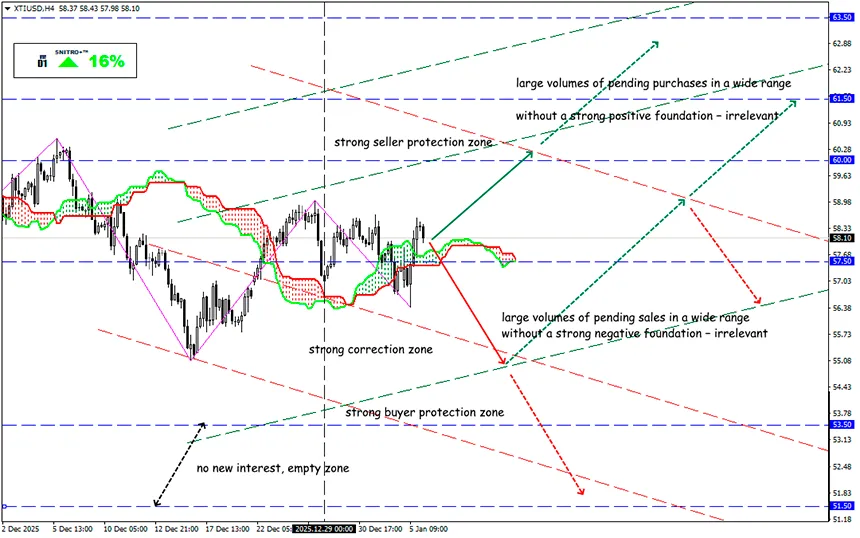

XTI/USD

Key zone: 57.50 - 58.50

Buy: 59.00 (on strong positive fundamentals); target 61.50-63.50; StopLoss 58.30

Sell: 57.50(on a pullback after retesting the 58.50 level); target 55.00; StopLoss 58.20

Expectations of a sharp rise in oil prices amid the Venezuelan crisis appear overstated. Despite intense media attention and geopolitical rhetoric, the fundamental picture of the commodities market remains unfavorable for a sustainable increase in quotations.

U.S. media are actively promoting the version that pressure on Venezuela is linked to its external debt, drug trafficking issues, a democracy crisis, etc. However, for the global market the key objective is obvious: the world’s largest proven oil reserves, estimated at approximately 303 billion barrels.

OPEC+ Reaction and Current Export Status

OPEC+ chose to take a wait-and-see position and confirmed production cuts in the first quarter, seeking to clarify the situation around Venezuela. Exports from the region are effectively paralyzed: loaded tankers are not leaving the zone of military control, which temporarily removes Venezuelan oil from global circulation.

Caribbean oil will not flow into markets immediately, if only because its production requires more expensive infrastructure and logistics. Years of corruption, chronic underfunding, accidents, fires, and theft have brought the country’s oil industry into a critical condition.

At present, Venezuela produces about 800 thousand barrels per day. Even if sanctions are lifted, production growth is estimated at only ≈150 thousand barrels per day over several months. A return to levels of 2 million barrels per day and above is possible only with sectoral reforms and the attraction of large-scale investments.

Behavior of Speculators and Commodity Funds

After the end of the prolonged U.S. shutdown, the CFTC resumed publication of data on the positioning of large speculators. Current statistics indicate active purchases of commodities and related assets, including commodity currencies sensitive to oil prices.

Capital inflows into commodity ETFs were observed throughout the entire past year and may repeat. The main drivers of interest are elevated inflation and geopolitical instability, rather than a shortage of physical supply.

Oil Corporations: Caution Instead of a Race

Trump’s statements that Washington will dictate terms to new Venezuelan leaders strengthened expectations of corporate competition for access to resources. In practice, however, the situation looks restrained:

- ExxonMobil, Chevron, and ConocoPhillips are exercising caution due to political instability, a negative history of expropriations, and the large investments required to increase production;

- Chevron, already operating in the country under a special license from the Trump administration, is considered the most likely candidate to expand its presence, but the company emphasizes personnel safety and asset security as priorities;

- Formally, access is open to producers from other countries, but not to opponents of the United States. China — the largest buyer of Venezuelan oil — together with Russian companies is effectively excluded from this market;

- Significant amounts of loans and compensation have still not been paid to companies whose assets were nationalized under Chávez. Nevertheless, a return is possible given sufficiently high oil prices and adequate risk premiums.

Market Balance and Price Outlook

The global market is oversupplied with oil, and quotations are near five-year lows. Market participants expect the impact of the conflict on global prices to be limited.

Nevertheless, the suspension of exports, including tankers insured by PDVSA’s key partner — Chevron — may accelerate the need to cut production at oil fields.

The emotional reaction to Maduro’s arrest had almost no impact on oil quotations, but remains a bullish signal for the U.S. stock market and crypto assets. The United States has obtained a powerful instrument for containing inflation in the form of the world’s largest oil reserves, which have de facto come under its control. Incidentally, Venezuela also has significant reserves of gold and rare earth metals — Trump will like that.

Short-term forecasts for 2026 remain unchanged: Brent: $58–60, WTI: $52–54. On the 6–12 month horizon, downside risks for prices across major benchmarks are increasing amid the expected growth of global supply.

So we act wisely and avoid unnecessary risks.

Profits to y’all!