Ripple abandons the IPO idea

The XRP issuer remains a private company

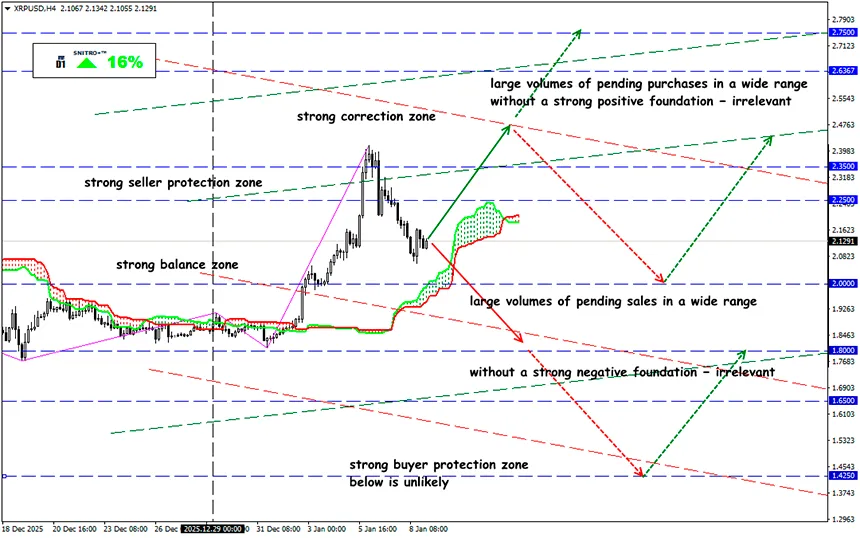

XRP/USD

Key zone: 2.000 - 2.250

Buy: 2.250 (after retesting the 2,100 level); target 2.45-2.50; StopLoss 2.180

Sell: 2.000 (on strong negative fundamentals) ; target 1.750; StopLoss 2.070

Ripple has officially abandoned the idea of a public offering, confirming its intention to retain private company status. According to Ripple President Monica Long, the company does not require public market liquidity to finance growth. She emphasized that an IPO is most often a capital-raising instrument rather than a strategic necessity — and in Ripple’s case, such a necessity does not exist.

The company maintains a sufficiently strong financial position, has access to large private capital, and is able to raise funding on favorable terms, allowing it to scale the business efficiently without going public.

Scaling via M&A and Institutional Focus

The decision to abandon the IPO was made amid aggressive business expansion. During 2025, Ripple completed four major M&A transactions totaling approximately $4 billion, consistently building a comprehensive digital asset infrastructure for corporate and institutional clients.

In November, a $500 million funding round took place with participation from Fortress Investment Group, Citadel Securities, and a number of cryptocurrency funds. Monica Long described the deal terms as extremely favorable for the company, while declining to disclose whether investor interests influenced Ripple’s discussed valuation of $40 billion.

The acquisition portfolio included:

- Hidden Road — a global prime broker;

- Rail — a stablecoin payments platform;

- GTreasury — a treasury management solutions provider;

- Palisade — a custodial company.

These deals reflect Ripple’s transition from a narrow crypto specialization to an infrastructure provider model focused on financial institutions.

Product Ecosystem and the Role of RLUSD

A key element of Ripple’s ecosystem is the dollar-denominated stablecoin RLUSD, which underpins the Ripple Payments and Ripple Prime products. The latter was launched following the acquisition of Hidden Road and is aimed at institutional services, including collateralized lending and XRP-related products.

As of November, Ripple Payments processed more than $95 billion in payments, indicating steady growth in demand for cross-border settlements.

The company’s strategic objective is the creation of practical, revenue-generating solutions that simplify the integration of blockchain technologies into traditional financial systems.

Why the IPO Idea Lost Relevance

Discussions around an IPO had been ongoing since 2022 and were directly dependent on the outcome of litigation with the SEC. Regulatory uncertainty long blocked any steps in this direction.

However, even after the case concluded, Ripple did not return to active preparation for a listing. During this period, the company strengthened its financial base, expanded its product lineup, and gained access to large-scale private financing, reducing the strategic need to enter the public market.

The abandonment of an IPO also appears logical against the backdrop of disappointing IPO results for crypto companies in 2025. Public offerings in the U.S. overall underperformed the S&P 500, while many debutants faced sharp corrections:

- Circle — after a strong debut, shares declined noticeably;

- Bullish — prices returned to IPO levels;

- Gemini — one of the worst IPOs of the year, with shares down more than 60%.

XRP: Market Dynamics and Reference Levels

After peaking near $3.66 in 2025, the XRP/USD pair ended the year approximately 21% lower, reflecting a reassessment and subsequent correction following a strong rally.

At present, XRP shows a moderate recovery, trading in the $2.1–$2.3 range. The dynamics reflect the market’s reaction to institutional demand and the launch of new investment products.

The medium-term picture remains mixed:

- Upside potential toward $3 and above persists under favorable demand conditions and strengthening institutional interest;

- Current prices indicate resilience above $2, although corrections are possible if interest weakens or sentiment in the crypto market deteriorates.

At the same time, the absence of an IPO reduces XRP’s sensitivity to short-term speculative factors, shifting investor focus toward Ripple’s fundamental business indicators.

So we act wisely and avoid unnecessary risks.

Profits to y’all!