What Matters More for the Fed – the Labor Market or Inflation?

The Federal Reserve Makes Its Choice

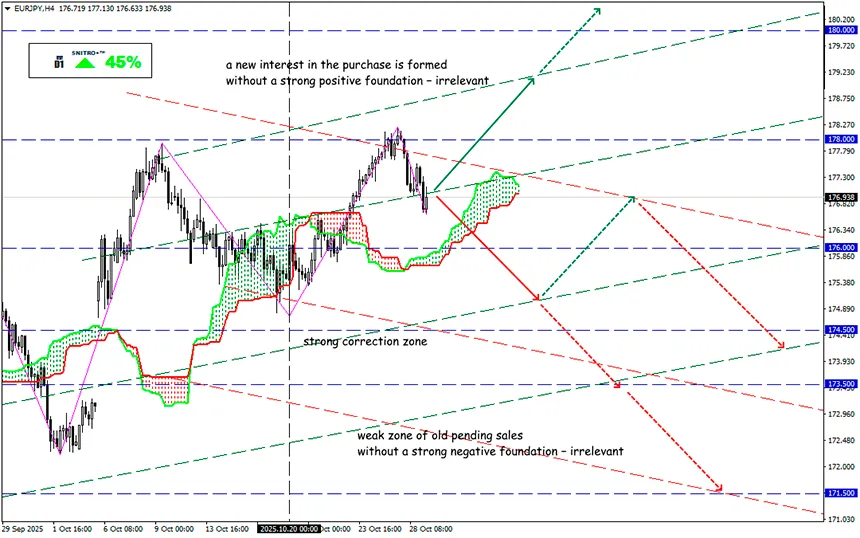

EUR/JPY

Key zone: 176.50 - 177.50

Buy: 178.00 (on strong positive fundamentals) ; target 179.50-180.00; StopLoss 177.50

Sell: 176.00 (on a pullback after correction to 176.80) ; target 174.50; StopLoss 176.50

Monetary policy is a constant balance between short-term stability and long-term risks.

The Fed’s task is to control inflation and ensure maximum employment, but today the directions of this dual mandate are diverging. Measures that stimulate demand are beneficial for the labor market — yet they are the very same measures that drive price growth.

Today the Fed is expected to cut the federal funds rate by 25 basis points — this is the second rate cut in 2025. The goal is clear: to support a labor market that is losing optimism. Lowering the rate stimulates activity ahead of the holiday shopping season, boosts consumer demand, and allows businesses to pass part of the tariff costs onto ordinary Americans.

However, the downside of policy easing is obvious: cheap credit fuels inflation. If the rate remains high, companies will be more cautious about hiring, and employment growth will slow.

According to Bloomberg, the number of initial jobless claims for the week ending October 11 decreased to 215,000 compared with 234,000 the previous week — a temporary relief amid general turbulence.

The partial government shutdown is hindering the publication of official statistics. According to the Partnership for Public Service, about 900,000 federal employees have been furloughed without pay, while another 700,000 continue to work without paychecks. Some states allow such employees to receive unemployment benefits, but after funding is restored, these payments must be returned.

If the White House succeeds in implementing its mass layoff plan, unemployment could rise catastrophically. Several months without work are an unaffordable luxury for most Americans: 37% of the population have no savings — not even $500 for unforeseen expenses.

Fears that tariffs will once again accelerate inflation have temporarily disappeared from the market agenda, yet the shutdown and tariff threats continue to create uncertainty, complicating decision-making.

For example, seven out of nineteen FOMC members see no reason to cut rates this year, but long-term forecasts (which will not be updated today) still assume one more cut before year-end.

If the Fed’s independence comes into question, the rate will become a political instrument rather than a financial indicator. In that case, it will turn into a symbol of trust in the U.S. financial system.

In fact, the Fed has left the door open in both directions — and the market believes it.

For Powell, it is especially difficult to maintain balance right now. Any mistake could cost him market trust: a dovish tone supports the economy but undermines confidence in the regulator’s independence.

As a result, the dollar and Treasury bonds risk losing their status as anchor assets of the global financial system.

Today, the market does not expect clear signals from the Fed regarding future policy direction. Powell will most likely try to preserve decision-making flexibility and avoid any concrete commitments until the end of the year.

So we act wisely and avoid unnecessary risks.

Profits to y’all!