Uptober Is Back in the Game

October – the Optimal Period for the Crypto Market

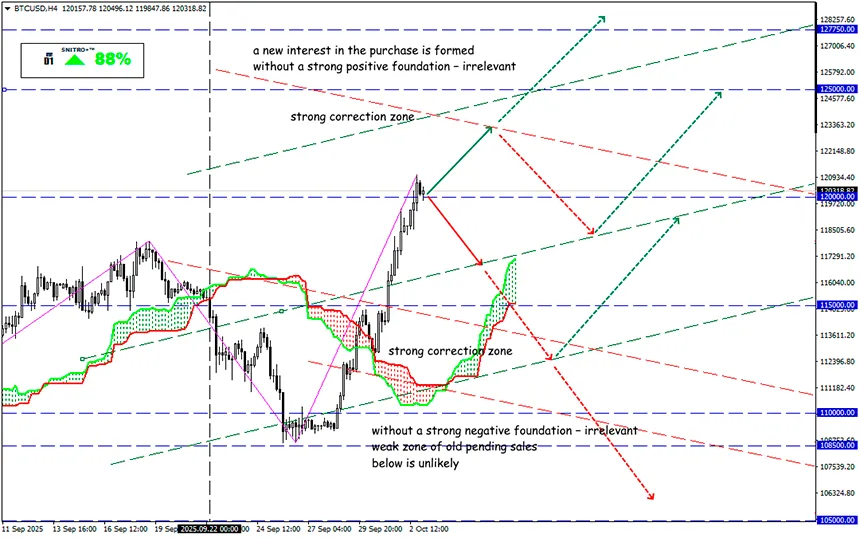

BTC/USD

Key zone: 117,500 - 121,500

Buy: 121,500 (on a pullback after a correction to 118,500); target 123500-125,00; StopLoss 120,500

Sell: 117,500 (on strong negative fundamentals) ; target 115,000-113,500; StopLoss 118,500

The cryptocurrency market often frightens with its volatility, but October year after year demonstrates a consistent upward trend. It is during this month that Bitcoin traditionally posts strong performance, pulling the entire crypto market along with it.

The meme Uptober emerged as an ironic description of Bitcoin’s successful October dynamics and quickly expanded beyond professional chats. Today, Uptober has become an annual ritual of growth expectations: the start of the month brings a wave of trading ideas and predictions about a "bull market."

The first significant Uptober was in 2013, when Bitcoin gained 60% in a single month. In 2014, however, October turned negative – BTC fell nearly 13%, and other tokens dropped 8–10%. Since then, only once – in 2018 – did October end in decline, while all other years (even during the pandemic) delivered steady gains:

- 2015: +33.5%,

- 2017: +47.8%,

- 2020: +27.7%,

- 2021: +39.9%,

- 2023: +28.5%.

Why does crypto rally specifically in October?

The key lies in market psychology. September traditionally ends with profit– taking after Q3 and nine– month results, exerting heavy pressure on markets. Cryptocurrencies, as hedging assets, suffer alongside everything else. As a result, October is perceived as a fresh starting point and a turning threshold. Funds, traders, and holders anticipate a reversal before year– end, so every fundamental factor is interpreted as bullish, and any positive price action receives an extra boost from the herd effect.

The start of the U.S. corporate earnings season also plays an important role. Institutional investors rebalance portfolios ahead of annual bonuses and a potential year– end rally, reinforcing demand for risk assets. Macro factors – including Fed and other central bank meetings – further fuel optimism.

Today, Uptober is not just about statistics and active speculation – it is part of crypto culture. Posts with the hashtag #Uptober have become a tradition on social media, while the enthusiasm of traders and holders creates a Rosenthal effect: collective growth expectations turn into a self–fulfilling prophecy. And Bitcoin is "forced” to rise – because everyone wants profits.

Right now, fundamental factors and community sentiment suggest that the upcoming Uptober 2025 could also deliver notable results. But only if we approach the market with attention and respect.

So we act wisely and avoid unnecessary risks.

Profits to y’all!