Political Chaos Hits the Economy

France Turns Into the EU’s Outsider

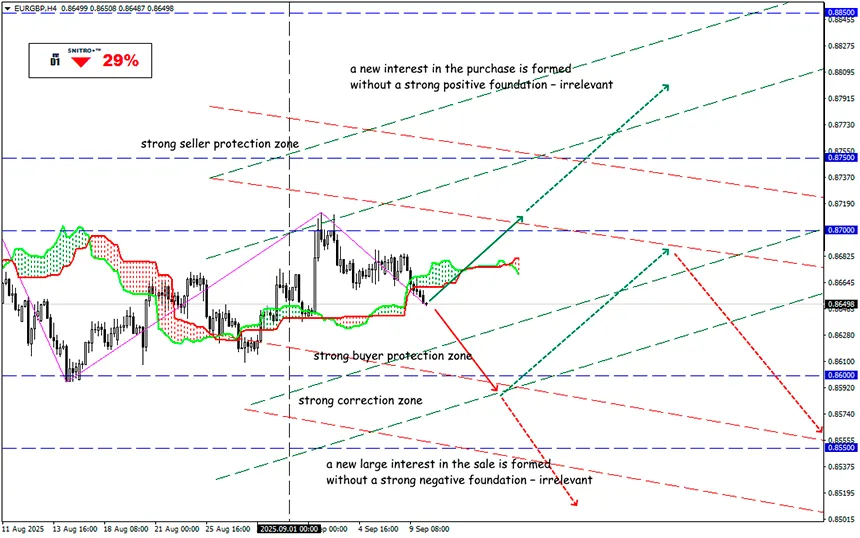

#EURGBP

Key zone: 0.8620 - 0.8680

Buy: 0.8700 (after a solid breakdown of 0.8680); target 0.8850; StopLoss 0.8630

Sell: 0.8600 (on strong negative fundamentals) ; target 0.8450; StopLoss 0.8670

The opposition has forced Prime Minister François Bayrou, a centrist, to resign over his plans to cut the budget by €44 billion ($52 billion). The prolonged government crisis is restraining business activity and consumer demand, turning Paris into a high-risk part of the eurozone periphery.

There is virtually no prospect of resolving the crisis. The new government must present a budget plan for 2026 by October 7, but its content will likely be less ambitious – and certainly won’t risk experimenting with tax hikes.

The country is sinking into a debt mire. In June, public debt reached €3.3 trillion, or 114% of GDP. This is still below Greece (153%) and Italy (138%), but unlike them, France has no budget surplus. The Court of Auditors warns that if growth slows and deficit-cutting measures fail, debt payments could exceed €100 billion by 2029. For comparison: in 2024, this figure was €59 billion, already the largest item of budget expenditure.

President Macron has no plans for early parliamentary elections, calling them politically pointless and too costly for the budget. Sébastien Lecornu, the former defense minister whom Macron appointed as the new prime minister, said he would work to restore political stability in the country.

Meanwhile, unions are staging a major protest today under the slogan “Block Everything,” announced back in summer. We’ll see how the security forces handle the consequences of traditional French street unrest.

Financial markets are forced to react: the prospect of higher taxes and slower growth already worries investors. French 10-year bonds have shown a speculative jump in yields (3.47–3.49%), higher than Greek and Italian debt. In political chaos, France must pay an increased risk premium.

Instability puts pressure on the euro, though the correlation between French sovereign risks and the exchange rate remains weak. A strong reaction is possible only under acute stress. For now, the negative impact is mainly visible in the banking sector: shares of BNP Paribas, Crédit Agricole, and Société Générale have lost 8–10%.

Despite this local, exclusively European crisis, the euro is still holding up against the U.S. dollar and may even keep a short-term uptrend. Overall, French risks are already priced in; expected pressure is limited to 0.5–0.75% and likely temporary. However, technical resistance levels – 1.1800 for EUR/USD and 0.8700 for EUR/GBP – may cap further growth, as Europe currently lacks fundamental positives.

So we act wisely and avoid unnecessary risks.

Profits to y’all!