Federal Reserve vs. Trump: The Final Round

The market awaits the Fed’s rate decision

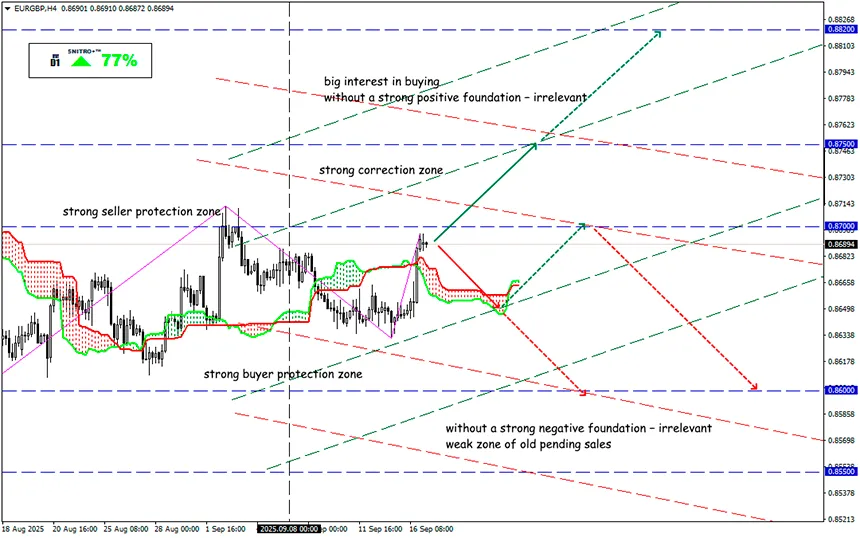

#EURGBP

Key zone: 0.8650 - 0.8700

Buy: 0.8700 (after a retest of 0.8650); target 0.8850; StopLoss 0.8640

Sell: 0.8600 (on strong negative fundamentals) ; target 0.8500-0.8450; StopLoss 0.8660

The upcoming FOMC meeting promises to be the most unusual in the past decade. Markets reasonably expect a 0.25% rate cut against the backdrop of weak labor market data. However, the decision comes under direct political pressure from the Trump administration, raising doubts not only about the Fed’s independence but also about the effectiveness of its governance.

Politics vs. Monetary Authority

The conflict between the White House and the Fed is complicated by ongoing legal disputes regarding the committee’s composition, the details of which remain unclear. The attempt to remove Lisa Cook from voting was unsuccessful, but an economic adviser to Trump was quickly appointed to the vacant seat, with the obvious goal of aggressively lobbying his boss’s interests. This ensures that the search for consensus will be difficult.

The Main Intrigue – How Many Cuts?

A 0.25% rate cut is almost a given. Investors are now focused on the quarterly forecast and the number of potential adjustments before year-end. These parameters will dominate Powell’s press conference and set expectations for the two remaining Fed meetings this year.

Labor Market vs. Inflation

The Fed’s forecasts must answer three key questions:

- How serious is the labor market slowdown?

- At what pace should rates be cut to reach the “neutral” level?

- Where exactly is that “neutral” level now?

The employment picture looks alarming. In July, job gains stood at 150K, but after revisions only 96K, while the three-month average dropped to just 29K. For the first time since 2021, the number of unemployed has exceeded the number of job openings. Whether such data can be trusted is another issue.

In July, the Fed kept rates unchanged due to inflation concerns. Powell suggested moving toward a “neutral” rate, estimating it at 4.3%, while other committee members placed it closer to 3%. The current economic backdrop is less favorable for aggressive easing than a year ago.

Last month, Powell expressed more concern about labor market weakness than about inflation dynamics. The question now is whether he will reinforce this stance after the disappointing August report.

At key technical levels across major assets, pending volumes are already in place and will be triggered speculatively depending on Fed signals. For yen-related assets, additional attention will focus on BOJ decisions, which could generate technical reversal signals in medium-term trends. However, such reversals must be backed by fundamental confirmation.

So we act wisely and avoid unnecessary risks.

Profits to y’all!