Gold to Get a Digital Format

London Market Prepares to Test a New Settlement System

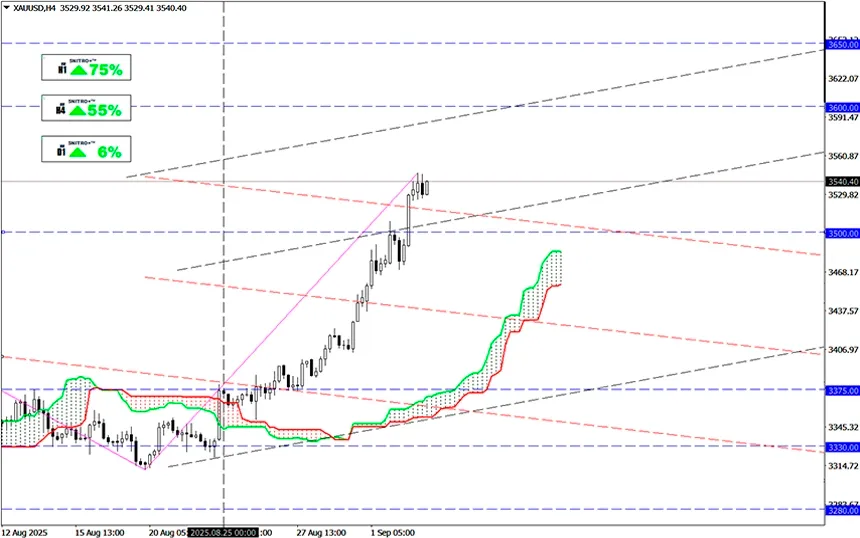

#XAUUSD

Key zone: 3,450.00 - 3,550.00

Buy: 3,500.00 (on a pullback after a correction); target 3,650.00; StopLoss 3,420.00

Sell: 3,420.00 (after a strong breakdown of 3.450); target 3,250.00; StopLoss 3,500.00

The World Gold Council (WGC) is launching a digital gold project that could reshape the structure of the London physical gold market, valued at over $900 billion. The new trading model introduces an updated format for settlements and bullion delivery guarantees.

Reminder:

The London “Loco” market is the world’s largest center for physical gold trading. It is built on the assets of major commercial banks, including HSBC and JPMorgan, as well as the Bank of England’s gold storage facilities. Transactions are traditionally conducted over-the-counter, directly between counterparties.

Currently, the market offers two types of operations:

- Allocated gold transactions (a specific bullion bar),

- Unallocated gold transactions (a quantity without linking to specific bars).

WGC now plans to introduce a third type of OTC transaction — digital gold.

Investors value traditional gold for its physical form and the absence of counterparty risk. However, the new format will allow the metal to be “applied” as digital collateral within the gold ecosystem. Digitalization of bullion will expand the trading range so that financial products used in other markets can also be applied to gold trading in the future.

All attempts to create gold-backed stablecoins have failed. The most notable projects — Tether Gold and Pax Gold — manage assets worth around $1.3 billion and $1 billion, respectively, which is negligible compared to the $400 billion concentrated in gold ETFs.

Now a new digital unit, PGIs (“pooled gold interests”), has been proposed. It will allow banks and investors to buy or sell ownership rights to physical gold stored in separate accounts. The system is scheduled for testing with commercial participants in London in the first quarter of next year.

Some market participants expect resistance to the innovation, since the London gold market is dominated by large players traditionally averse to risk.

Over the past three years, gold has doubled in price. Currently, quotes are firmly holding above $3,500, and the $3,600–3,650 zone looks achievable. However, sentiment remains cautious: the fundamental backdrop is moderately negative, and the market needs a technical correction. No signs of a bullish trend reversal are evident yet.

So we act wisely and avoid unnecessary risks.

Profits to y’all!