Prediction market: where the new generation invests

Polymarket receives capital from 1789 Capital fund

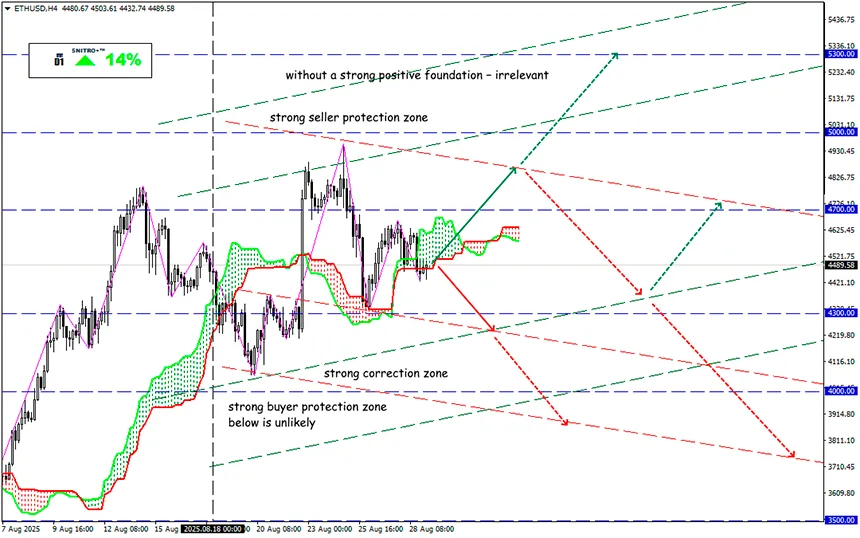

#ETHUSD

Key zone: 4,300.00 - 4,600.00

Buy: 4,600.00 (after a retest of 4,700); target 4,850-4,950; StopLoss 4,500.00

Sell: 4,300.00 (on a strong negative foundation) ; target 4,100-4,000; StopLoss 4,400.00

Donald Trump Jr. made a major investment in the cryptocurrency platform Polymarket; through his fund 1789 Capital, the son of the US president invested tens of millions of dollars into the project.

Reminder:

Polymarket is a decentralized platform on Ethereum, allowing users to bet on the probability of any events. Essentially, it is a mix of financial betting, sports wagering, tarot reading, and other forecasting methods.

Talks between Polymarket and 1789 Capital began 18 months ago. However, the new partner preferred to delay actual investment until Donald Trump Sr.’s crypto initiatives reduced regulatory uncertainty in the US.

The company was founded in 2020 and operates on the Polygon blockchain using USDC. In 2022, the platform restricted access for US citizens after a scandal and CFTC restrictions. In July 2025, the US Department of Justice and the CFTC closed investigations without charges, and Polymarket returned to the US market. Soon after, the company acquired derivatives exchange QCEX, licensed by the CFTC, for $112M.

Trump Jr.’s fund invested during this period. Although he is not on the investment committee and does not directly participate in asset allocation, his role on the advisory board strengthens Polymarket’s position.

According to Donald Trump Jr., prediction markets “allow us to overcome the influence of media and expert opinions,” giving people the chance to bet based on their own expectations. The president’s son believes that everyone has a sufficiently professional opinion about everything happening, and anyone can place a bet on that opinion.

Shane Coplan noted that the participation of Trump’s fund capital would strengthen Polymarket’s status as a “reliable source of free and accurate market information.” Deal details are undisclosed, but in Donald Trump Sr.’s terms, it was certainly a “magnificent, brilliant deal.”

Curiously, Trump Jr. also remains a strategic advisor to Kalshi, a competing prediction platform. Thus, he strengthens his influence on the growing prediction market sector.

Interestingly, ordinary market price forecasts on Polymarket are not popular — they fail too often. Judging by the fact that we still manage to earn without Polymarket predictions, classic fundamental and technical analysis remain more reliable tools.

So we act wisely and avoid unnecessary risks.

Profits to y’all!